Fit and Proper Criteria

Fit and Proper Criteria refer to a set of regulatory standards used to assess the suitability of individuals appointed to key positions in banks and financial institutions, such as directors, promoters, senior management, and key managerial personnel. These criteria are central to corporate governance and prudential regulation, ensuring that persons entrusted with managing financial institutions possess integrity, competence, and sound judgement. In the context of banking, finance, and the Indian economy, fit and proper norms play a vital role in safeguarding financial stability and public confidence.

Concept and Rationale of Fit and Proper Criteria

Financial institutions manage public savings and play a systemic role in the economy. Weak governance or unethical leadership can lead to mismanagement, fraud, and systemic crises. Fit and proper criteria are therefore designed to prevent unsuitable individuals from controlling or influencing financial institutions.

The underlying rationale is that the soundness of financial institutions depends not only on capital and regulation but also on the quality, integrity, and competence of their leadership.

Regulatory Framework in India

In India, fit and proper criteria are prescribed and enforced by the Reserve Bank of India and other sectoral regulators for their respective domains. The RBI issues detailed guidelines applicable to banks, non-banking financial companies, and certain regulated intermediaries.

These criteria are applied at the time of appointment and on a continuing basis, recognising that suitability is an ongoing requirement rather than a one-time assessment.

Scope of Applicability

Fit and proper norms apply to a wide range of individuals associated with regulated financial entities, including:

- Promoters and major shareholders.

- Directors, including independent directors.

- Chief executive officers and whole-time directors.

- Senior management and key managerial personnel.

The objective is to ensure that those with decision-making authority or significant influence meet minimum standards of propriety and competence.

Key Components of Fit and Proper Assessment

The fit and proper assessment typically covers three broad dimensions. Integrity and reputation examine honesty, ethical conduct, and past behaviour, including any involvement in fraud, financial misconduct, or regulatory violations. Competence and capability assess professional qualifications, experience, and ability to manage complex financial operations. Financial soundness evaluates personal financial integrity, including solvency and absence of willful default.

Together, these components ensure holistic evaluation of suitability.

Role in Banking and Corporate Governance

Fit and proper criteria are a cornerstone of corporate governance in banking. By ensuring that boards and management are composed of capable and ethical individuals, these norms strengthen oversight, risk management, and strategic decision-making.

Effective governance reduces the likelihood of excessive risk-taking, related-party transactions, and conflicts of interest, thereby protecting depositors and investors.

Importance for Financial Stability

Failures in leadership and governance have been a common factor in financial crises globally. Fit and proper norms act as a preventive tool by reducing the probability of governance-related failures that can destabilise individual institutions and the wider financial system.

In India, these criteria gained prominence following episodes of bank stress linked to weak governance and concentrated control.

Ongoing Monitoring and Disclosure

Fit and proper compliance is not limited to initial vetting. Regulated entities are required to conduct periodic reviews and promptly report any material changes affecting an individual’s suitability.

Directors and senior executives must submit declarations and disclosures regarding their interests, background, and any adverse developments, ensuring transparency and accountability.

Challenges in Implementation

Assessing fitness and propriety involves judgement and discretion, which can pose challenges. Information asymmetry, evolving risk profiles, and complex ownership structures can complicate assessments.

Balancing regulatory scrutiny with managerial autonomy and ensuring consistency across institutions remain important implementation issues.

Impact on the Indian Economy

At the macroeconomic level, fit and proper criteria contribute to trust in the financial system. Strong governance enhances confidence among depositors, investors, and international counterparties, supporting stable capital flows and economic growth.

A well-governed banking system is better positioned to allocate credit efficiently, support productive investment, and withstand economic shocks.

JEEVAN c m

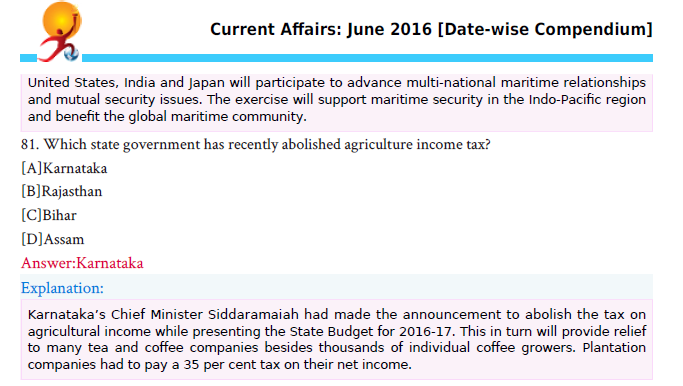

February 1, 2017 at 6:30 pmSir this question is not in the June magazine. Can you please tell me in which month it was published

GKToday

February 1, 2017 at 6:33 pmPlease check question 81 in June PDF.

JEEVAN c m

February 2, 2017 at 9:57 amSir I cant get this question in June 2016 magazine