Government constitutes Alternative Mechanism Panel for PSBs consolidation

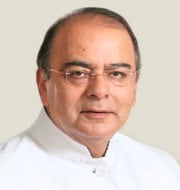

The Union Government has constituted Alternative Mechanism Panel headed by Union Finance Minister Arun Jaitley to oversee merger proposals of public sector banks (PSBs). The other members of the panel include Railway and Coal Minister Piyush Goyal and Defence Minister Nirmala Sitharaman.

Key Facts

This alternative mechanism has been set up by the government to fast-track consolidation among public sector banks to create strong lenders. The mechanism will oversee the proposals coming from boards of PSBs for consolidation.

The decision comes after government had announced Rs. 2.11 trillion bank recapitalisation plan for public sector banks weighed down by bad loans, seeking to stimulate flow of credit to spur private investment. It was also announced that recapitalisation plan will be accompanied by series of banking reforms over next few months. The constitution of an Alternative Mechanism is move in that direction.

The Union cabinet in August 2017 had decided to set up Alternative Mechanism to fast-track PSU bank consolidation. More about alternative mechanism (fig)

Purpose of PSBs consolidation

The move to create large banks through consolidating PSBs aims at meeting credit needs of growing Indian economy and building capacity in PSB space to raise resources without dependence on the state exchequer. The banking entities formed after merging PSU banks will be able to absorb shocks.

Background

The idea of bank mergers was around since 1991, when former Reserve Bank of India (RBI) governor M. Narasimham had recommended the government merge banks into three-tiered structure, with three large banks with an international presence at top. In 2014, PJ Nayak Committee also had suggested that government either merge or privatize state-owned banks.

Significance of PSBs consolidation

- Reduce their dependence on government for capital.

- Open up more capital generation avenues, both internally and from market, for the merged entity.

- From a government point of view, it will increase stream of dividends which forms part of their non-tax revenue.

- Increase the role of internal and market resources and thus reduce dependence of merged bank on government for the future capital infusion

- It will lead to greater concentration of payment and settlement flows as there will be fewer parties in the financial sector.

- Operational risks could increase post-merger as size of operations grows and distance between management and operational personnel is greater as the administrative systems become more complex.

- It will help to deal better with their credit portfolio, including stressed assets. Consolidation will also prevent multiplicity of resources being spent in t same area and strengthens banks to deal with shocks,

Month: Current Affairs - October, 2017